Tax Audit Defense Services for IRS and State Audits

When the IRS or a state tax agency initiates an audit, experienced representation matters. We provide tax audit defense services for individuals and business owners, managing the process from notice to resolution with more than 24 years of experience.

Professional Representation During Tax Audits

Tax audits are procedural reviews governed by strict rules, deadlines, and documentation standards. Handling them properly requires knowledge of audit procedure, tax law, and examiner expectations.

Our tax audit defense services are focused on representation. We communicate directly with the IRS or state agency, manage requests, and guide the process step by step. Clients are not left interpreting notices or responding on their own.

This approach allows audits to be handled professionally, with attention to detail and consistency across filings, records, and explanations.

Our Tax Audit Defense Services

IRS Audit Representation

We represent clients during IRS examinations by managing all communication with the agency. This includes responding to information requests, coordinating document submissions, and addressing examiner questions throughout the audit process.

State Tax Audit Defense

State tax audits often involve residency determinations, income sourcing, or reporting issues. We represent clients before state tax authorities, handle correspondence, and guide the examination through resolution.

Audit Notice Review

We review audit notices to understand the scope, deadlines, and focus of the examination. This early review helps determine what information is required and how the audit should be approached.

Documentation and Response Preparation

We assist with gathering records, preparing written responses, and organizing documentation in a manner that aligns with tax law and prior filings. Proper preparation helps reduce confusion and unnecessary follow-up.

Tax Appeals Support

When audit findings are disputed, we support clients through the appeals process by preparing documentation, outlining positions, and guiding discussions with appeals officers.

Begin Your Audit Defense With Experienced Representation

Audits move quickly and require clear responses. Working with experienced professionals helps reduce stress and avoid missteps during the process.

Nationwide Representation

500+ Years of

Combined Experience

Direct IRS and State Communication

How Our Tax Audit Defense Process Works

Audit Review and Assessment

We begin by reviewing the audit notice, prior filings, and relevant records to understand the scope of the examination, deadlines involved, and areas that may require closer attention.

Defense Strategy Planning

Our CPAs, Tax Attorneys, and IRS Enrolled Agents evaluate the situation and determine how the audit should be handled, including what information should be provided and how responses should be structured.

Representation and Communication

We communicate directly with the IRS or state tax agency on your behalf. This includes submitting documentation, responding to inquiries, and managing all examiner interactions.

Resolution and Follow-Up

After the audit concludes, we review the outcome with you and advise on resolution, appeals if needed, or steps that may help reduce future audit risk.

Who Our Tax Audit Defense Services Are For

Our audit defense services support clients who want experienced representation during tax examinations.

Individuals Facing IRS or State Audits

Clients who have received notices related to income, deductions, or reporting.

High-Income Taxpayers With Complex Returns

Audits involving equity compensation, investments, or multiple income sources.

Business Owners and Professionals

Audits connected to business income, pass-through entities, or ownership structures.

Clients With Prior Filing Questions

Situations requiring clarification, documentation, or procedural guidance during an audit.

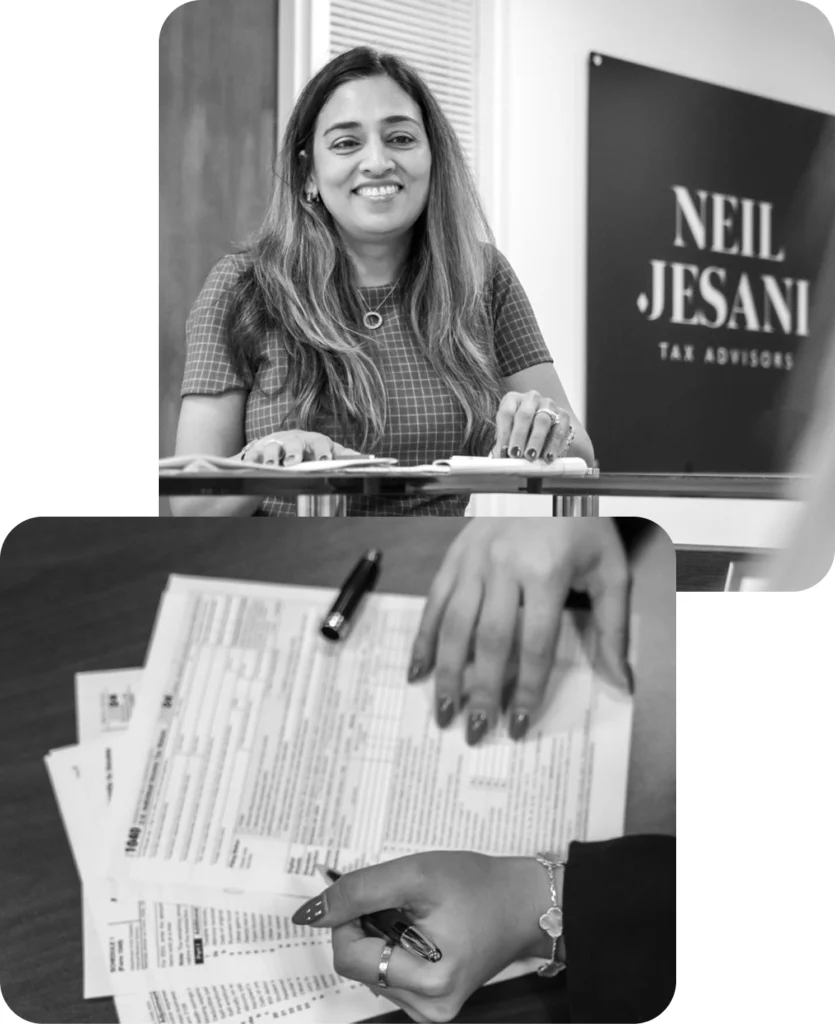

Your Audit Defense Team

Audit defense requires both technical tax knowledge and familiarity with audit procedures. Clients work with a coordinated in-house team that may include:

- Certified Public Accountants reviewing filings and records

- Tax Attorneys handling procedural and legal matters

- IRS Enrolled Agents representing clients before tax authorities

- Senior tax advisors overseeing audit strategy

This structure allows each audit to be reviewed from multiple perspectives before responses are submitted.

A Clear, Procedural Approach to Audit Defense

Direct Representation

We communicate directly with the IRS or state tax agencies on your behalf, removing the burden of responding to notices or examiner inquiries on your own.

Careful Documentation Review

All records and written responses are reviewed for accuracy, consistency, and proper support under current tax law before submission.

Procedure-Focused Defense

Every audit is handled according to established federal and state procedures to protect your rights and ensure the process stays within proper guidelines.

Tax Support For Every Sector

Client Profiles We Commonly Support During Audits

We work with high-income professionals and business owners across a range of fields. Our tax advisory services are designed around complex income, ownership, and compensation structures rather than specific industries.

Healthcare Professionals

Physicians, practice owners, and medical partners facing audits related to high earnings, partnership allocations, or practice income.

Legal and Professional Services

Law firm partners and professionals with compensation structures that include distributions, equity interests, or multi-entity reporting.

Technology Professionals

Executives and senior employees audited for stock compensation, bonuses, equity transactions, or multi-state income reporting.

Real Estate Investors

Audits involving rental income, property sales, depreciation, entity ownership, or transaction timing.

Manufacturing and Trade Business Owners

Owners of operating businesses reviewed for payroll treatment, retained earnings, or business-to-owner income reporting.

Why Clients Choose Neil Jesani Advisors for Audit Defense

Facing an audit requires more than basic tax knowledge. Clients choose our firm for structured representation, experienced oversight, and clear handling of the audit process from start to finish.

Proven Audit Experience For more than 24 years, we have represented individuals and business owners in IRS and state tax examinations involving complex income, reporting, and documentation issues..

Senior In-House Representation Audit defense is handled by CPAs, Tax Attorneys, and IRS Enrolled Agents working together within one firm. This ensures consistent review, coordinated responses, and professional representation at every stage.

Focused Client Approach We intentionally work with fewer than 1,000 clients. This allows our team to give each audit the attention it requires without passing matters through a high-volume system.

Nationwide Audit Support We represent clients in audits conducted by federal and state tax authorities across the United States, regardless of where the examination originates.

Clear and Direct Communication Clients receive timely updates, straightforward explanations, and guidance throughout the audit so they understand what is happening and what to expect next.

Trusted by Clients Across the United States

They are very knowledgable and professional. Rich has been incredible in educating me about the different tax strategies, and developing compelling personalized strategies based on my financial outlook. Raniya has been amazing in keeping the overall process organized and efficient, and Sally has helped ensure smooth execution.

Frequently Asked Questions

Tax audit defense services provide professional representation during an IRS or state tax audit. The goal is to manage communication with tax authorities, respond to document requests, and guide the audit process according to tax law and procedural rules.

An audit notice outlines what the IRS wants to review and sets deadlines for response. It is important to act quickly. Our team reviews the notice, explains what is being examined, and takes over communication with the IRS to ensure responses are accurate and timely.

Yes. As part of our tax audit defense services, we communicate directly with the IRS or state tax agency. Clients are not required to speak with examiners or respond to requests on their own.

Tax audit defense services are most useful for individuals and business owners with complex income, equity compensation, investment activity, or ownership structures. Professional representation helps ensure audits are handled properly and consistently.

Yes. We provide audit defense for both IRS and state tax examinations. State audits often involve residency, income sourcing, or reporting issues, which require careful procedural handling.

We assist with correspondence audits, office audits, and field examinations. The approach depends on the scope of the audit, the type of income involved, and the documentation requested by the tax authority.

Yes. We organize records, prepare written responses, and submit documentation in a way that aligns with tax law and prior filings. All responses are reviewed before submission.

If an audit results in proposed adjustments that you disagree with, we assist with the appeals process. This includes preparing supporting documentation and guiding the case through the appropriate appeal channels.

No. Tax audit defense focuses on direct representation by licensed professionals. We do not offer prepaid coverage plans. Our services are based on active representation and case-specific review.

Audit timelines vary depending on the scope of the examination and the responsiveness of the tax authority. Some audits resolve in a few months, while others may take longer. We keep clients informed throughout the process.

Yes. We provide tax audit defense services for clients across the United States, including audits conducted by federal and state tax agencies.

Your audit will be handled by a coordinated team that may include CPAs, Tax Attorneys, and IRS Enrolled Agents. Each case is reviewed internally to ensure consistency and accuracy.

Yes. All audit defense work follows current federal and state tax law and established audit procedures. Our role is to protect the client’s position while meeting all legal and reporting requirements.

You can begin by scheduling a consultation. We will review your audit notice, prior filings, and financial situation to determine the appropriate next steps and whether our audit defense services are a good fit.