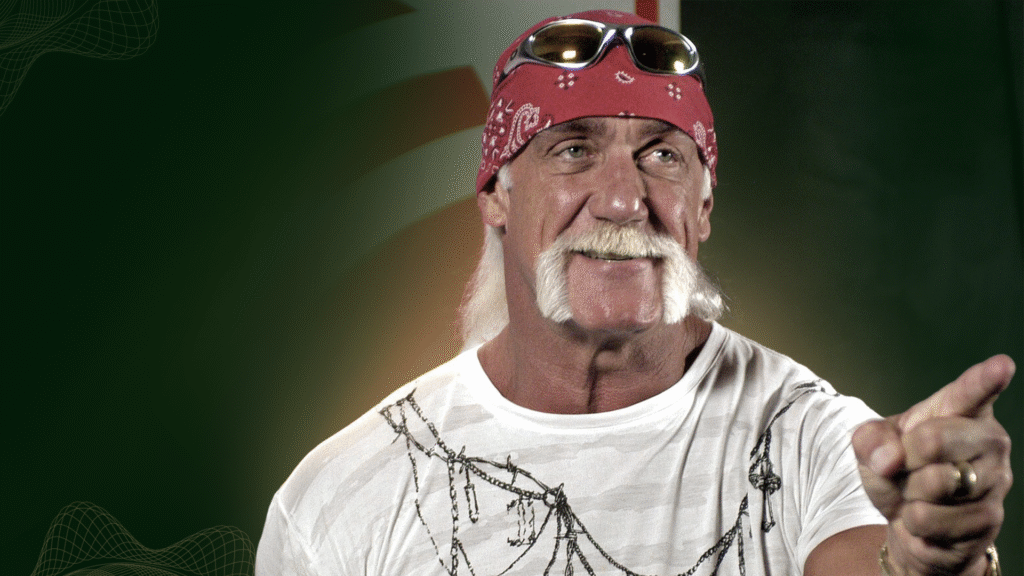

The death of wrestling legend Hulk Hogan (Terry Gene Bollea) on July 24, 2025, in Clearwater, Florida, shocked sports and entertainment communities. But behind the headlines and news reports, the administration of the Hulk Hogan’s estate can now possibly be a real-life case study of how Florida inheritance law intersects with family dynamics and estate planning decisions.

For wealthy individuals, the unfolding Terry Bollea is a timely reminder: advanced planning tools can protect assets so long as they are used, directed, and orchestrated well. As the next several months will probably show, even the strongest legal structures can be vulnerable when personal background and state law intersect.

Assets of Hulk Hogan Estate

As per Wikipedia, Hogan’s business, acting, and wrestling career paid him an estimated $25 million. His wealth is estimated to consist of:

- Real estate: A Clearwater Beach compound valued at approximately $11.5 million.

- Running businesses: Hogan’s Beach Shop and Hogan’s Hangout, both in Florida.

- Intellectual property: Rights in the “Hulk Hogan” and “Hulkamania” trademarks, which he transferred to Hogan Holdings Limited in 2007. The corporate structure offers tax benefits and centralized management.

- Other assets: Income from endorsement, investments, and personal memorabilia.

This combination of property, operating assets, and intangible brand rights makes the Hulk Hogan estate a difficult package to value and split. And while the inventory of assets is overwhelming, it also sets the stage for potential celebrity estate disputes if heirs and legal rights are not established.

So where does the Florida law come in?

Florida Inheritance Law and Its Impact

Hogan was married for the third time, to Sky Daily, when he died. Florida inheritance law provides an elective share for a surviving spouse of at least 30% of the decedent’s “elective estate” regardless of the terms of the Hulk Hogan wills. The Florida elective share act applies even to brief marriages.

Homestead protections also give surviving spouses strong Florida spousal rights to remain in the primary residence for life. For Hogan, this would mean Sky Daily retaining ownership of the Clearwater property even if devised otherwise to children or placed in trust.

These rights, which are meant to accrue to spouses, have the potential to dramatically alter the distribution of assets to inheritors. That is especially so when adult children of a former marriage are involved, which is a scenario that all too often ends with probate wars, and Florida courts must resolve.

Estate Planning Structures and Their Vulnerabilities

Reports indicate Hogan used both a revocable trust and a personal trust. In Florida, these estate planning structures can:

- Skip probate, and save time and attorney’s fees.

- Keep confidentiality by not placing asset information within open court documents.

- Provide some protection from creditor claims.

But even such robust trusts have their weaknesses:

- Inadequate funding: Unless assets are retitled in the trust name, they too will need to go through Hulk Hogan probate court.

- Outdated terms: Marriage, divorce, or kids must be updated instantly.

- Legal issues: Florida law permits a Florida contest of a trust upon grounds of undue influence, lack of capacity, or document defect.

In celebrity estates like Hulk Hogan’s estate, where publicity is hot, these flaws can rapidly transform technical struggles into front-page fights. And that leads us to the human component of this estate to the family.

Family Dynamics

The Hulk Hogan family feud has been a matter of public discourse for many years. Estrangements, reconciliations, and shifting allegiances can lay bare even the most open legal agendas to challenge. While specifics remain a secret, public records and past statements show strained relationships with at least one of his children named Brooke Hogan, his daughter from his first marriage.

It is reported that she was estranged from her father for two years before his death. Back in 2023, she asked for her removal from the main estate plan that could complicate Hulk Hogan’s inheritance discussion. Even if she doesn’t contest the will, her public statements and history with her father could still influence perceptions and potentially the actions of other family members.

Even if the family member does not oppose the Hulk Hogan inheritance, public doubt or disapproval can inspire other heirs or interested parties to move. The mixture of emotional past and legal entitlement is most commonly what turns a simple distribution into a long-standing dispute.

It’s a scene all too common to the Hulk Hogan widow inheritance case. Dozens of celebrity estates and hundreds of private ones have been remade by family battles.

Lessons in Estate Planning for Everyone

The following are lessons of Hulk Hogan’s estate planning:

Update documents after life events: Marriage, divorce, or the birth of additional children should prompt an instant revision of your trusts and will.

Complete your trusts: Make sure all your property is titled correctly in order to bypass probate contests in Florida.

Take marital contracts into account: Prenuptial or postnuptial contracts can create Florida spousal rights.

Exclusions from the record: In excluding heirs, record each reason to prevent a Florida trust contest.

Communicate intentions: Open communication reduces the likelihood of avoiding family inheritance disputes from becoming courtroom cases.

You don’t have to have billions or millions in assets to be at risk. Even small estates can have issues when planning is missing or out of date.

Takeaway

The Hulk Hogan’s estate drama is far from over, but already it does help to demonstrate the importance of combining legal strategy and personal reality. Florida law, family dynamics, and the size and complexity of an estate all enter into how smoothly or contentiously the process proceeds.

Preventative planning will not erase family history, but it will set strong guidelines that minimize conflict. Regardless of what your estate consists of, businesses, intellectual property, or even a family home, the same applies.

If you’d prefer to avoid the kind of uncertainty the Hulk Hogan’s estate is facing, contact Neil Jesani Advisors. Our complete estate plan, asset protection, and family wealth plan can help you protect your legacy and have your wishes upheld without the drama.